Get Ready for Smaller, More Affordable Homes

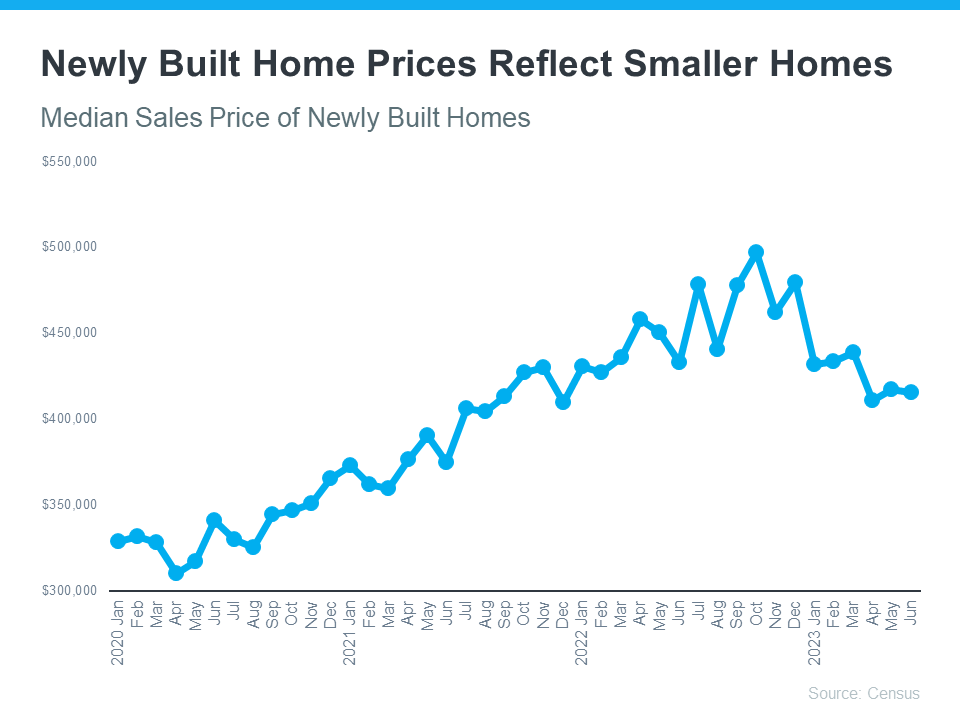

Have you been trying to buy a home, but higher mortgage rates and home prices are limiting your options? If so, here’s some good news – based on what Ali Wolf, Chief Economist at Zonda, has to say – smaller, more affordable homes are on the way:

“Buyers should expect that over the next 12 to 24 months there will be a notable increase in the number of entry-level homes available.”

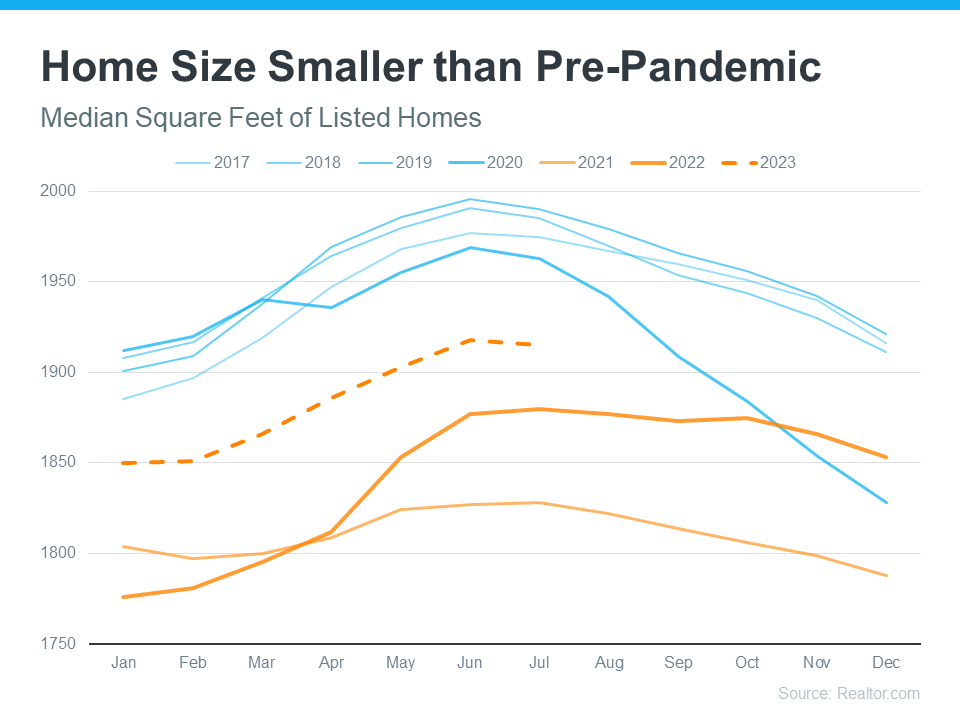

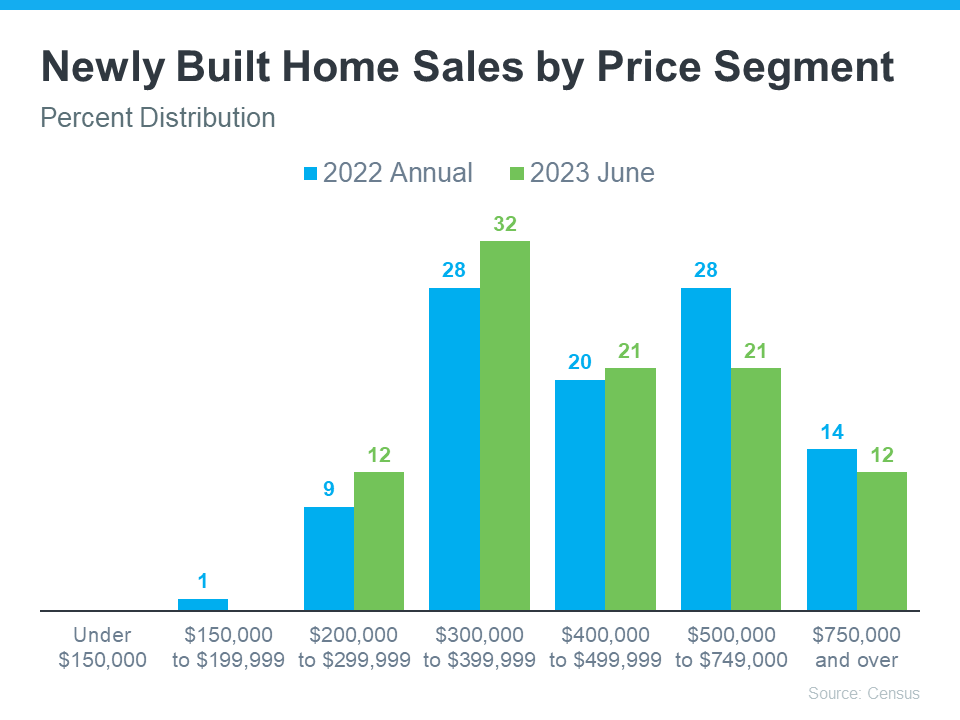

In some ways, smaller homes are already here. When the pandemic hit, the meaning of home changed. People needed the space their home provided not only as a place to live, but as a place to work, go to school, exercise, and more. Those who had that space were more likely to keep it. And those that didn’t were in a position where they were trying to sell their smaller house to move up to a larger one. That meant the homes coming to the market during the pandemic were smaller than those on the market before the pandemic – and that trend continues today (see graph below): This graph also shows how the size of homes on the market changes seasonally. Larger homes tend to come on the market during the summer months when households with children who are out of school are looking to move.

This graph also shows how the size of homes on the market changes seasonally. Larger homes tend to come on the market during the summer months when households with children who are out of school are looking to move.

That seasonality means, based on historical trends and the fact that fall is now approaching, we can expect smaller, more affordable homes to come to the market throughout the rest of the year.

That’s great news because, as Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), states, the need for these types of homes has gone up recently:

“. . . as interest rates increased in 2022, and housing affordability worsened, the demand for home size has trended lower.”

What Does This Mean for You?

The seasonal trend of smaller homes coming to the market in the later months of the year, coupled with builders bringing smaller, more affordable newly built homes to the market right now, is good news – especially if you’re finding it difficult to afford a home. Mikaela Arroyo, Director of the New Home Trends Institute at John Burns Real Estate Consulting, says this about a potential increase in the availability of smaller homes:

“It’s not solving the affordability crisis, but it is creating opportunities for people to be able to afford an entry-level home in an area.”

Bottom Line

If a smaller, more affordable home sounds appealing to you, good news – they’re coming. To keep up with what’s available in your area, connect with a local real estate agent.

|

|

|

JERRY TORRES’

Sr. Mortgage Loan Originator #TechieLoanOriginator | #JerryTorresPro Prime & NON-Prime Home Loans | Bank Statement Loans | ITIN | HELOCs |

![Home Prices Are Back on the Rise [INFOGRAPHIC] Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2023/08/Home-Prices-Are-Back-On-The-Rise-KCM-Share.png)