No matter how the housing market changes, there are some things about owning a home that never change—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours.

Over the last few years, we’ve fully embraced the meaning of our homes as we spent more time than ever in them. As a result, the emotional benefits our homes provide have become even more important to us.

As the most recent State of the American Homeowner from Unison puts it:

“. . . one thing has stayed the same: the home continues to be of the utmost importance and a place of security and comfort.”

The same study from Unison notes:

- 91% of homeowners say they feel secure, stable, or successful owning a home

- 64% of American homeowners say living through a pandemic has made their home more important to them than ever

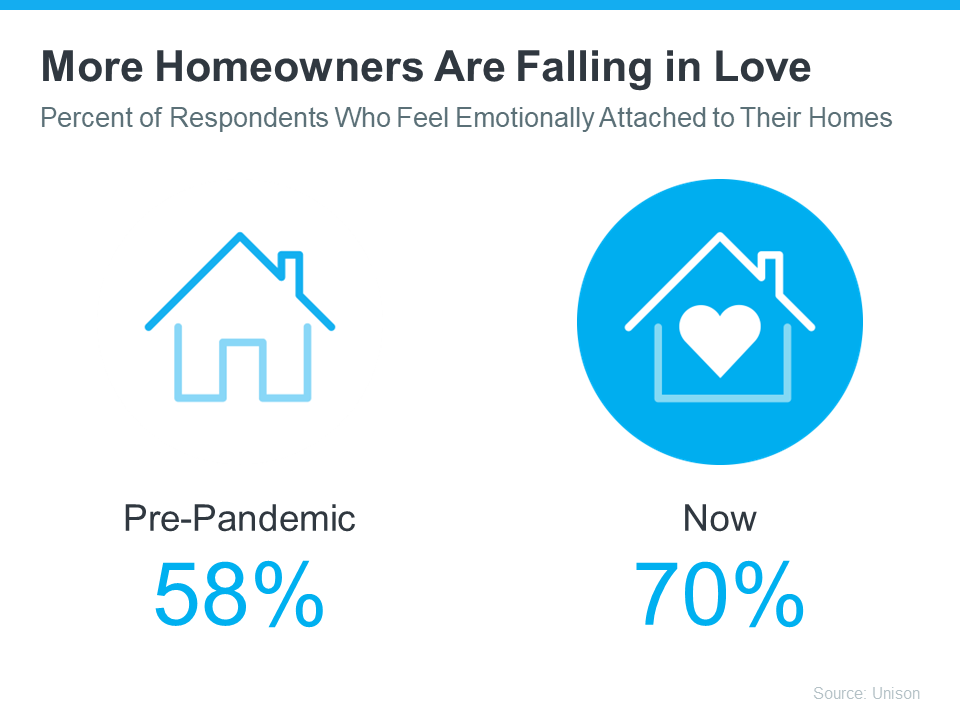

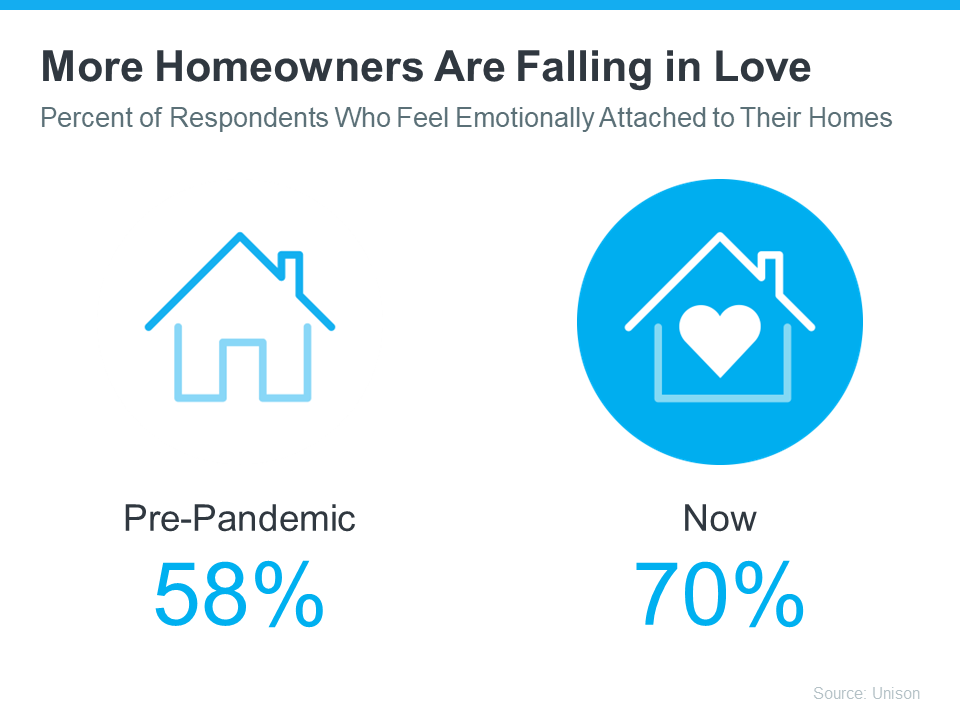

?It’s no surprise this study also reveals that homeowners now love their homes even more as our attachments to them have grown:

The National Association of Realtors (NAR) also explains:

“In addition to tangible financial benefits, homeownership brings substantial social benefits for [households], communities, and the country as a whole.”

In other words, not only does owning a home build your net worth over time, but it also gives you and your loved ones a place to thrive. And by living near people with shared experiences, homeownership helps you connect with your community and contribute meaningfully.

Bottom Line

Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, let me be the key to unlocking a home you can truly fall in love with.

![How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC] Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2023/02/How-To-Win-As-A-Buyer-In-Todays-Housing-Market-KCM-Share.png)

![How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2023/02/Resize-UPDATED-MEM_Homeownership-Builds-Your-Wealth-In-The-Over-Time-MEM.png)

![You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC] Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2023/02/You-May-Not-Need-As-Much-As-You-Think-For-Your-Down-Payment-KCM-Share.png)

![You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2023/02/You-May-Not-Need-As-Much-As-You-Think-For-Your-Down-Payment-MEM.png)