The True Cost of Not Owning Your Home

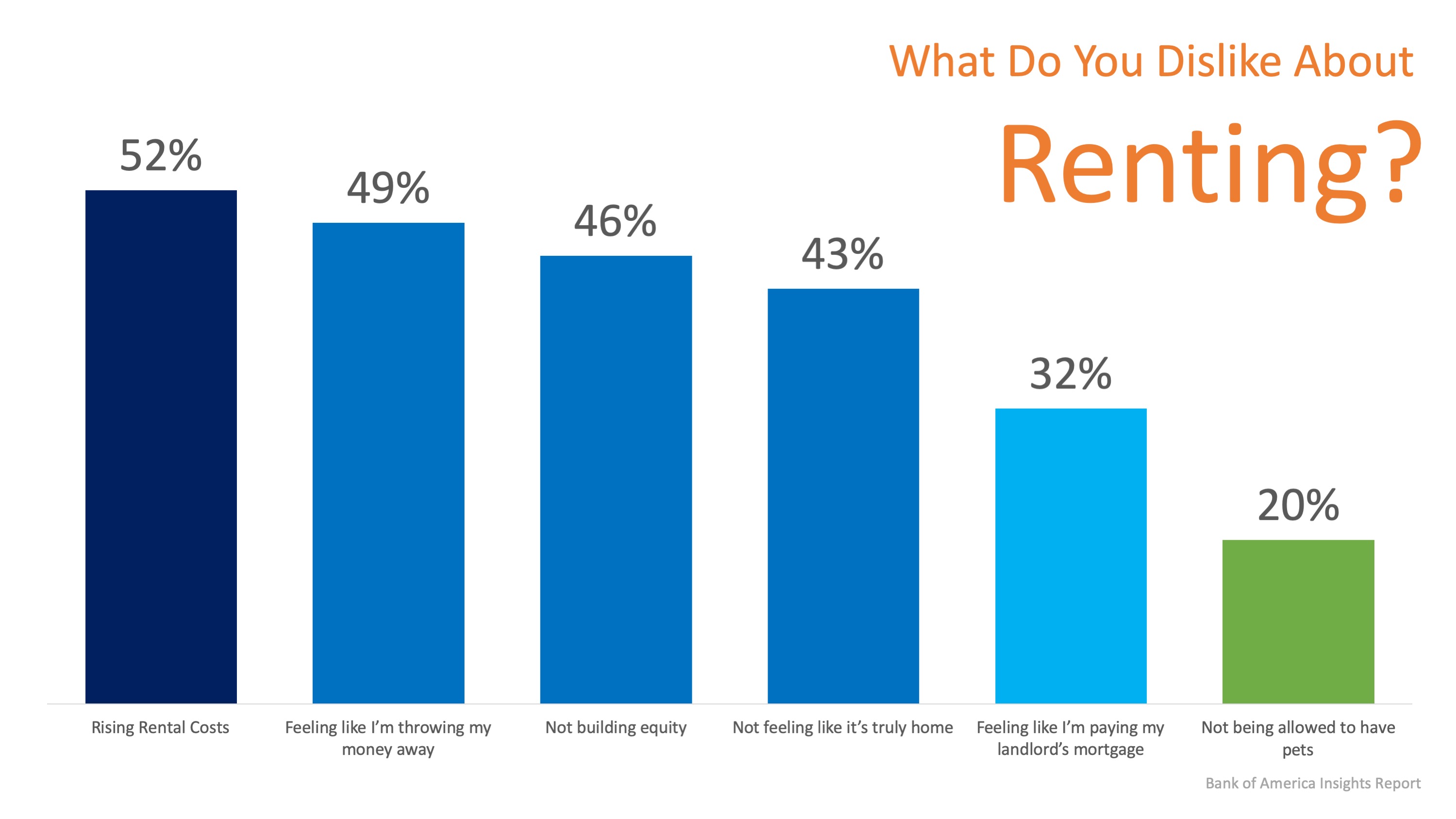

There are great advantages to owning a home, yet many people continue to rent. The financial benefits are just some of the reasons why homeownership has been a part of the long-standing American dream.

Realtor.com reported that:

“Buying remains the more attractive option in the long term – that remains the American dream, and it’s true in many markets where renting has become really the shortsighted option…as people get more savings in their pockets, buying becomes the better option.”

Why is owning a home financially better than renting?

Here are the top 5 financial benefits of homeownership:

- Homeownership is a form of forced savings.

- Homeownership provides tax savings.

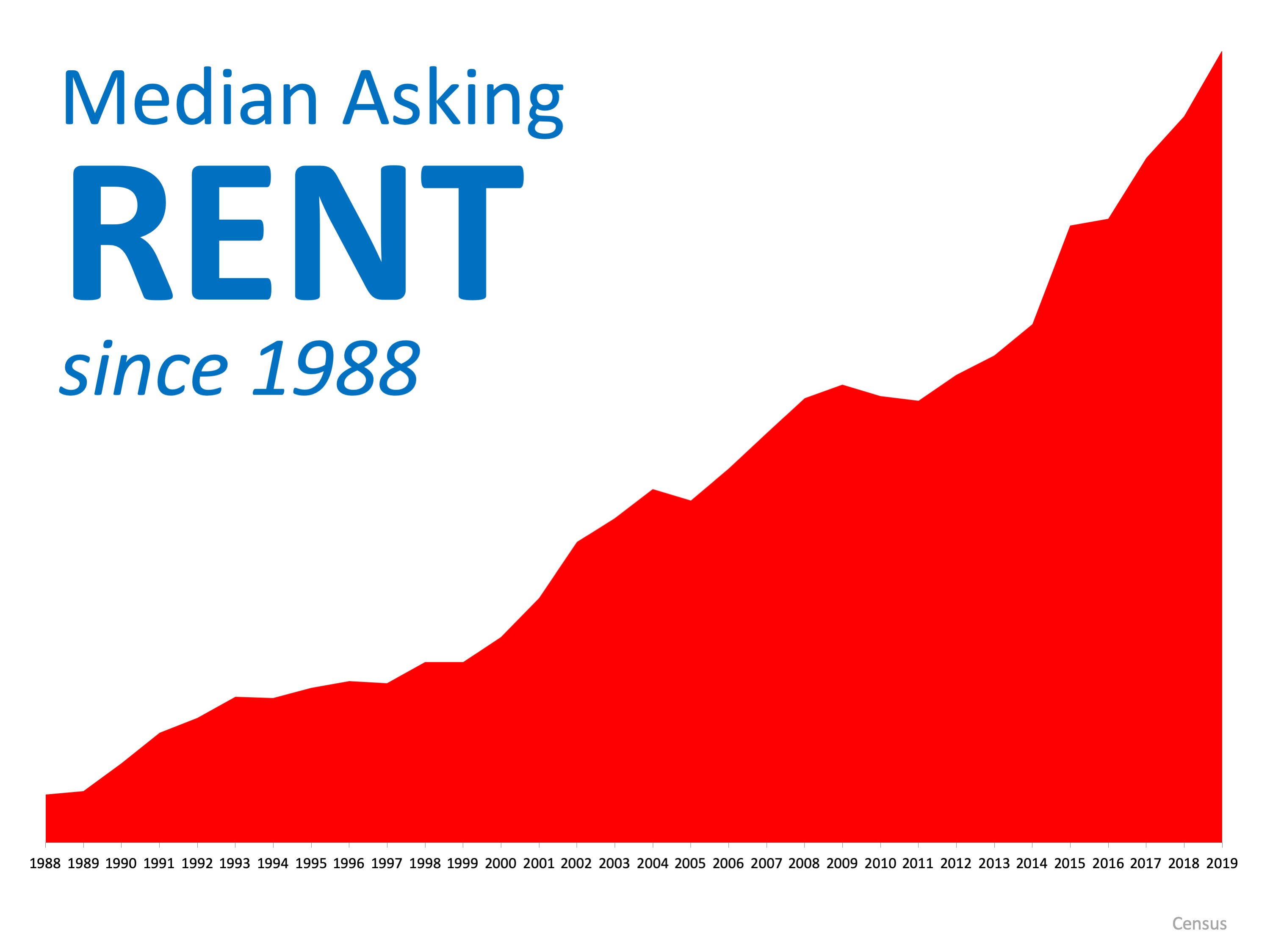

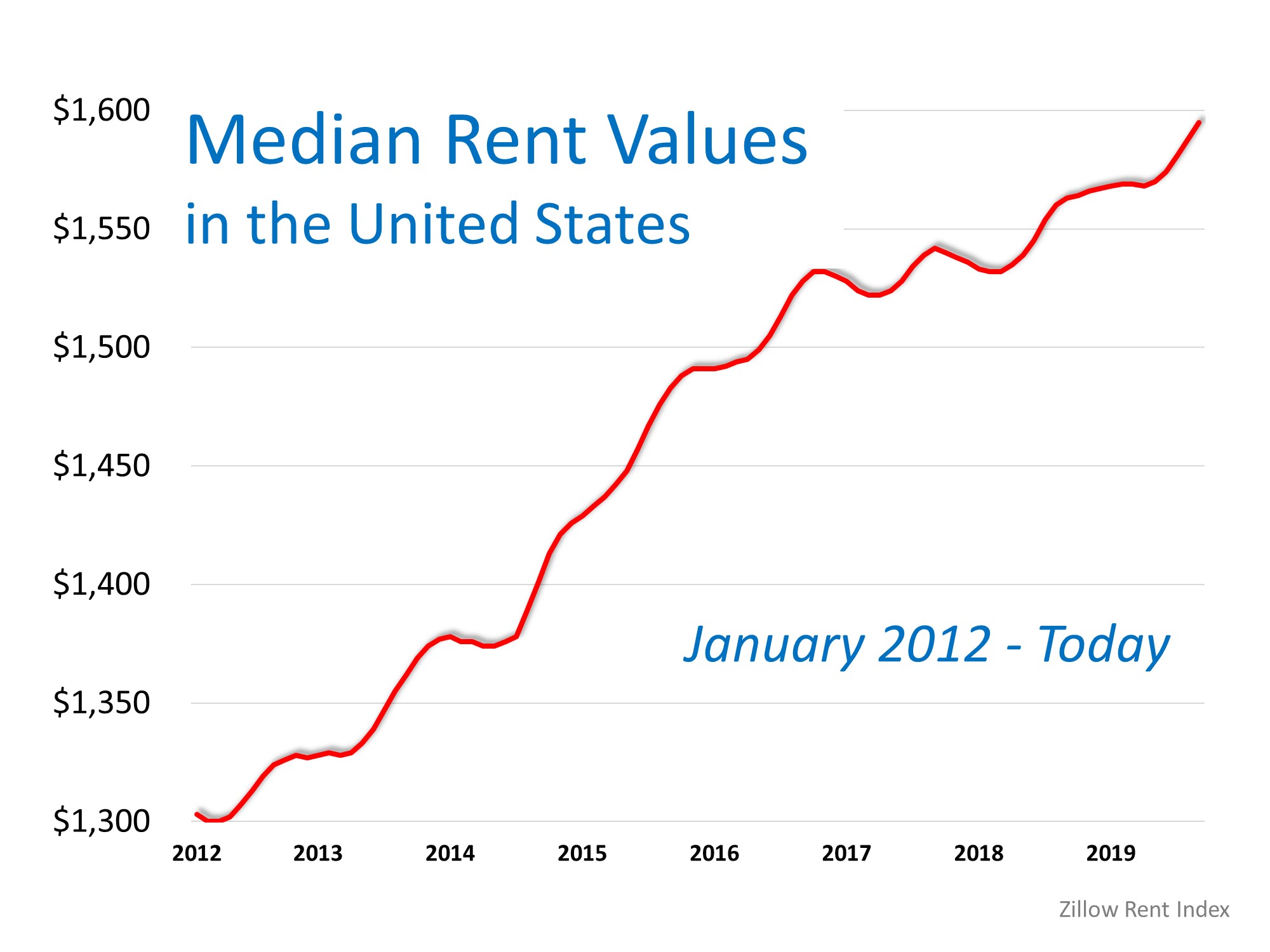

- Homeownership allows you to lock in your monthly housing cost.

- Buying a home is less expensive than renting.

- No other investment lets you live inside of it.

Studies have also shown that a homeowner’s net worth is 44x greater than that of a renter.

A family that purchased a median-priced home at the start of 2019 would build more than

$37,750 in family wealth over the next five years with projected price appreciation alone.

Some argue that renting eliminates the cost of taxes and home repairs, but every potential renter must realize that all the expenses the landlord incurs are already baked into the rent payment – along with a profit margin!

Bottom Line

Owning a home has many social and financial benefits that cannot be achieved by renting. Let’s connect to determine if buying a home is your best move.

|

|

|

JERRY TORRES Sr. Mortgage Loan Originator | Vision One Mortgage, Inc “THE PERFORMANCE TEAM”

#TechieLoanOriginator | #JerryTorresPro |

![The Cost of Renting vs. Buying a Home [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2019/11/20191115-MEM-ENG.jpg)

![Rent Vs. Own [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2019/08/20190809-MEM.jpg)