Why a Move Could Bring You More Happiness This Year

Over the past two years, we’ve lived through one of the most stressful periods in recent history. Because of the health crisis, many of us have spent more time at home and that’s led us to re-evaluate both what we need in a house and how much we appreciate having a safe space. If you’ve found your current home isn’t filling all your needs, you may be wondering if it’s time to find a new one.

There’s reason to believe a change of scenery could boost your happiness. Catherine Hartley, an Assistant Professor at New York University’s Department of Psychology and co-author of a study on how new experiences impact happiness, says:

“Our results suggest that people feel happier when they have more variety in their daily routines—when they go to novel places and have a wider array of experiences.”

A move could be exactly the new experience you’ve been looking for. If that’s something you’re considering to better your lifestyle, here are a few things to keep in mind.

Approach Your Decision Thoughtfully and Explore Your Options

Buying and selling a home is a major life change, and it’s not a decision you should enter lightly. But, if you’re questioning whether or not a move would bring you more happiness, it’s important to explore if it’s the right choice for you.

To find out more and discuss your options, reach out to a local real estate professional. They’ll explain the process – including how to list your existing house and search for a new one – in clear and simple terms.

You should also think about your lifestyle and what you’re hoping to get out of your move. What needs aren’t being met in your current home? What features would bring you more joy and make your life easier? For example, are you now working remotely and need a home office? Do you crave more fresh air and open outdoor space to unwind in? Knowing the answers to these questions can help you get started and position your real estate advisor to work with you so you can find just the right home.

Consider a Location with Weather That Will Boost Your Mood

Home features aren’t the only thing to consider. You should also weigh your options when it comes to location. Is the weather something that’s important to you? Does it have a tendency to impact your mood? If it does, you may want to factor it into your next move. The World Population Review shares:

“What states have the best weather? When evaluating each state for temperature, rain, and sun, some states stand out. . . . Climate and weather preferences are personal and subjective. . . . “

Better weather can mean different things to different people. Some prefer the heat, others cooler temperatures, and some want to experience all four seasons. Think about what makes you feel happiest and prioritize that in your home search. If you’re moving to a whole new location, your agent is a great resource with a strong network to support you along the way.

Bottom Line

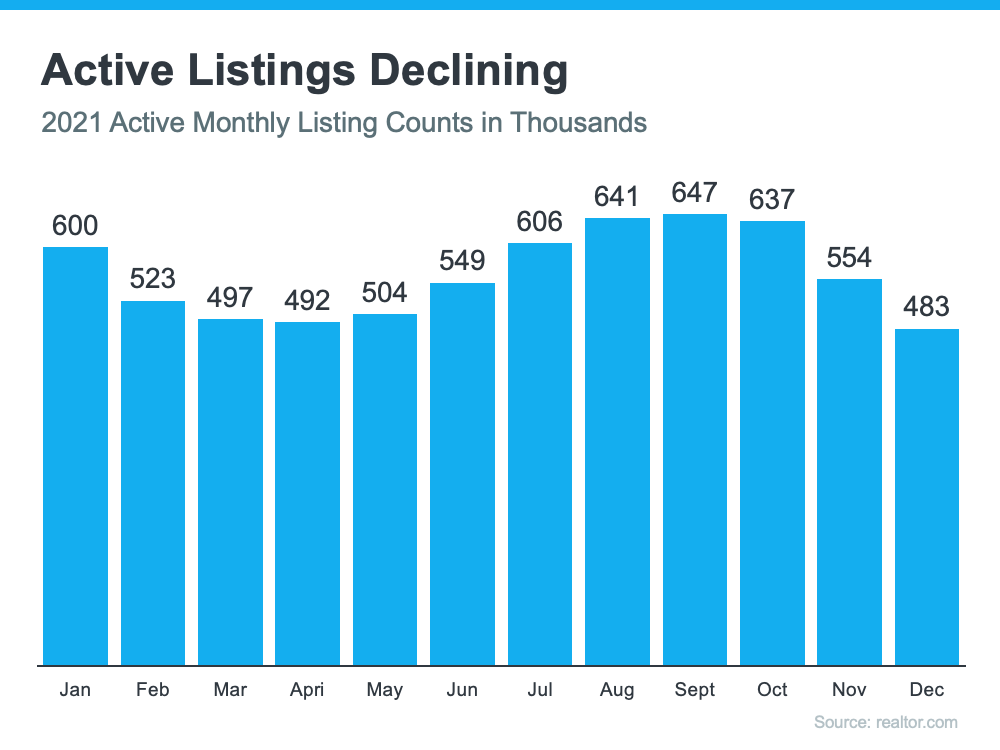

Moving could provide you with a fresh beginning and the chance to find happiness in your new home. Let’s connect today to talk about your goals and options in the current market.

|

|

|

JERRY TORRES’

Sr. Mortgage Loan Originator #TechieLoanOriginator | #JerryTorresPro Prime & NON-Prime Home Loans | Bank Statement Loans | ITIN | HELOCs |

![Why Your Home Inspection Matters [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2022/01/20220128_KCM-Share-549x300.png)

![Why Your Home Inspection Matters [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2022/01/20220128-MEM.png)