Win When You Sell (And When You Move)

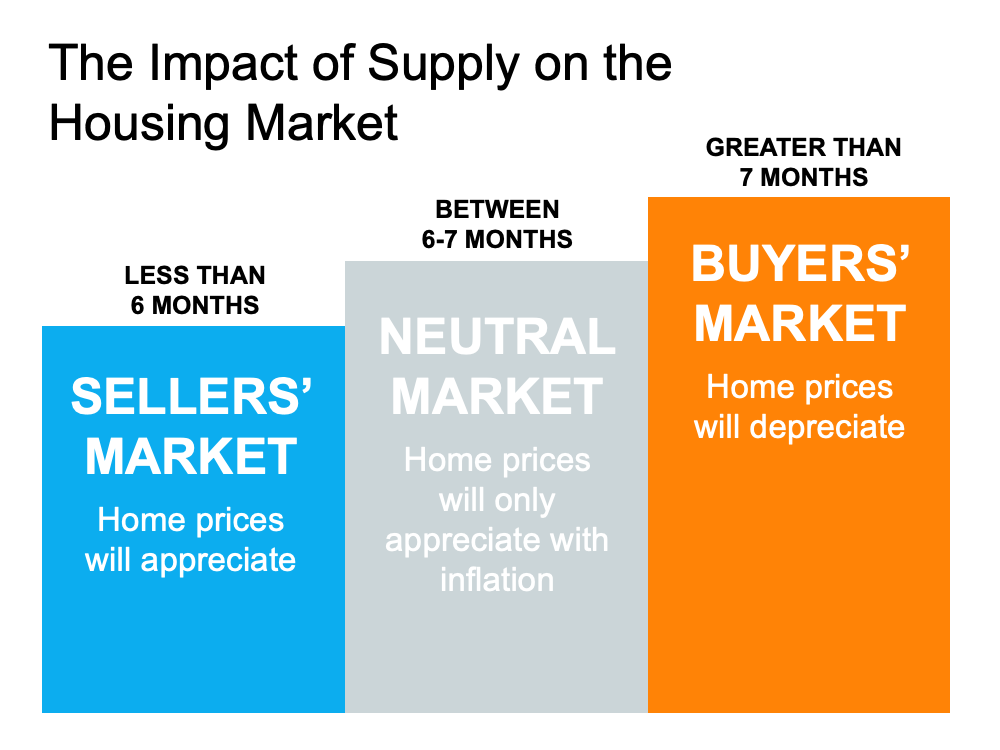

If you’re trying to decide when to sell your house, there may not be a better time than this winter. Selling this season means you can take advantage of today’s strong sellers’ market when you make a move.

Win When You Sell

Right now, conditions are very favorable for current homeowners looking for a change. If you sell now, here’s what you can expect:

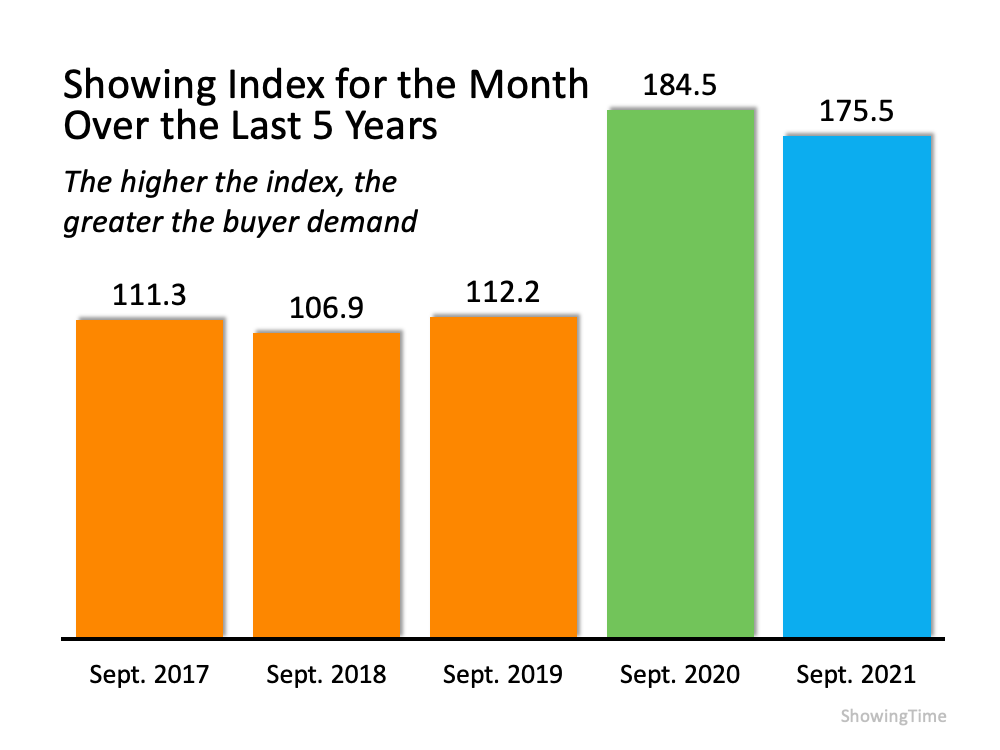

- Your House Will Stand Out – While recent data shows there are more sellers getting ready to list their homes this winter, there are still more buyers in the market than there are homes for sale. If you sell your house now before more houses are listed, it will get more attention from serious buyers who are eager to find a home.

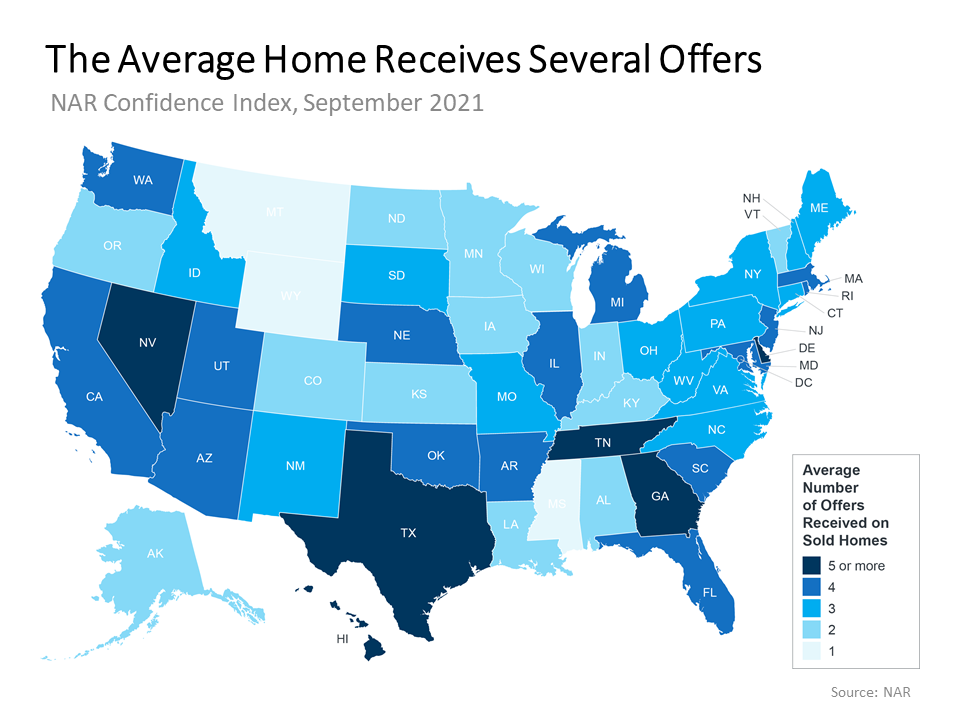

- Your House Will Likely Get Multiple Offers – When supply is low and demand is high, buyers have to compete with each other for a limited number of homes. The latest Realtors Confidence Index from the National Association of Realtors (NAR) shows sellers are getting an average of 3.6 offers in today’s market.

- Your House Should Sell Quickly – According to the same report from NAR, homes are selling in an average of just 18 days. As a seller, that’s great news for you if you’re looking for a quick process.

Win When You Move

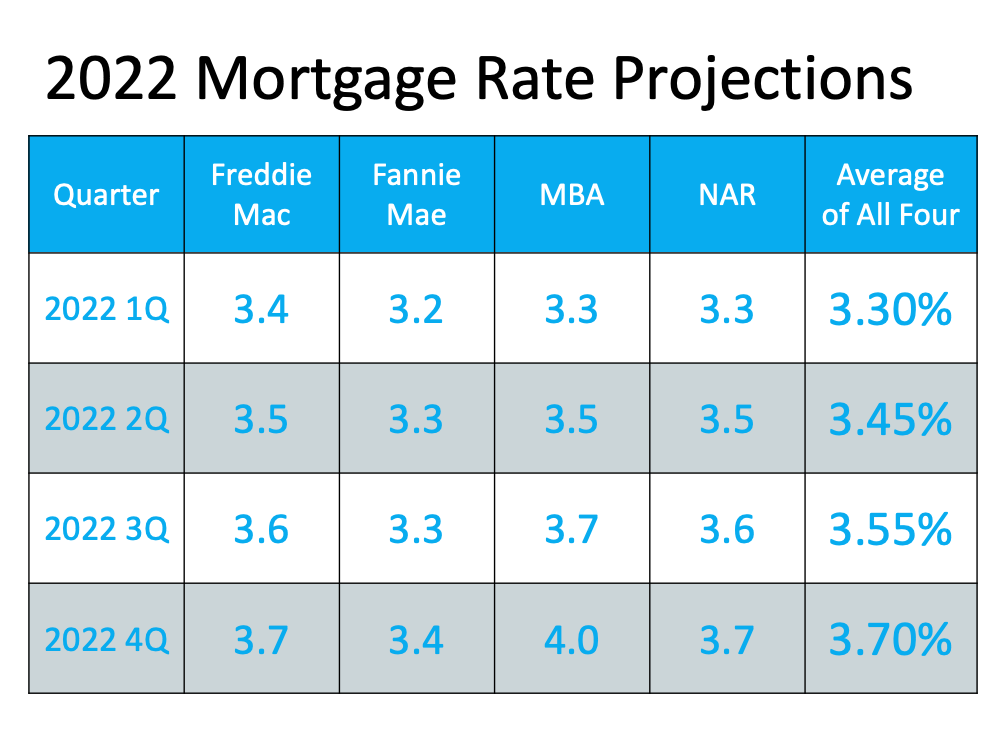

In addition to these great perks, you’ll also win big on your next move if you sell now. CoreLogic reports homeowners gained an average of $51,500 in equity over the past year. This wealth boost is the result of buyer competition driving home prices up. You can leverage that equity to fuel a move, before mortgage rates and home prices climb higher. To get a feel for how rates are projected to rise, see the chart below. The longer you wait to make your move, the more it will cost you down the road. As mortgage rates rise, even modestly, it will impact your monthly payment when you purchase your next home. Waiting just a few months to make that change could mean a long-term financial impact.

The longer you wait to make your move, the more it will cost you down the road. As mortgage rates rise, even modestly, it will impact your monthly payment when you purchase your next home. Waiting just a few months to make that change could mean a long-term financial impact.

The good news is today’s rates are still hovering in a historically low range. According to Doug Duncan, Senior VP and Chief Economist at Fannie Mae:

“Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low . . .”

Selling before rates climb higher means you can make your move and lock in a low rate on the mortgage for your next home. This helps you get more home for your money and keeps your payments down too.

Bottom Line

As a homeowner, you have a great opportunity to get the best of both worlds this season. You can truly win when you sell and when you buy. If you’re thinking about making a move, let’s connect so you have the information you need to get the process started.

|

|

|

JERRY TORRES’

Sr. Mortgage Loan Originator #TechieLoanOriginator | #JerryTorresPro Prime & NON-Prime Home Loans | Bank Statement Loans | ITIN | HELOCs |

![A Checklist for Selling Your House This Winter [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2021/12/20211203-KCM-Share-549x300.png)

![A Checklist for Selling Your House This Winter [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2021/12/20211203-MEM.png)

![Should I Update My House Before I Sell It? [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2021/11/20211112-KCM-Share-549x300.png)

![Should I Update My House Before I Sell It? [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2021/11/20211112-MEM.png)