A 365 Day Difference in Homeownership

Over the past year, mortgage rates have fallen more than a full percentage point. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them:

- Refinance: If you already own a home, you may want to decide if you’re going to refinance. It’s one way to lock in a lower monthly payment and save substantially over time, but it also means paying upfront closing costs too. You have to answer the question: Should I refinance my home?

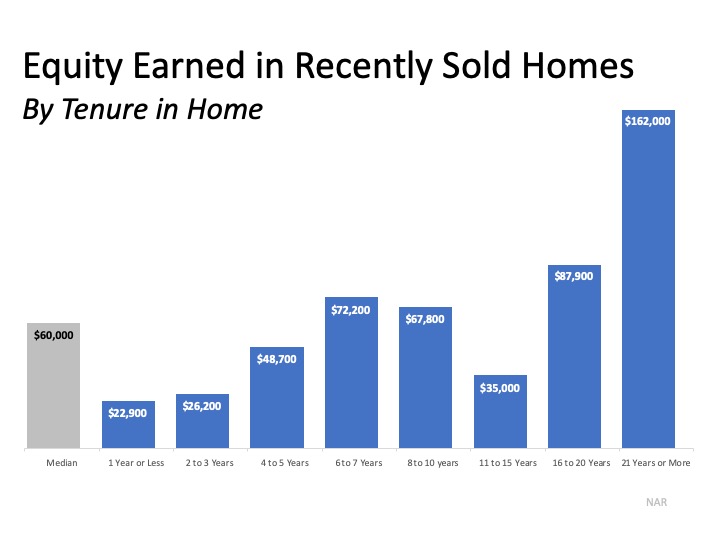

- Move-up or Downsize: Another option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that’s truly a perfect fit for your family.

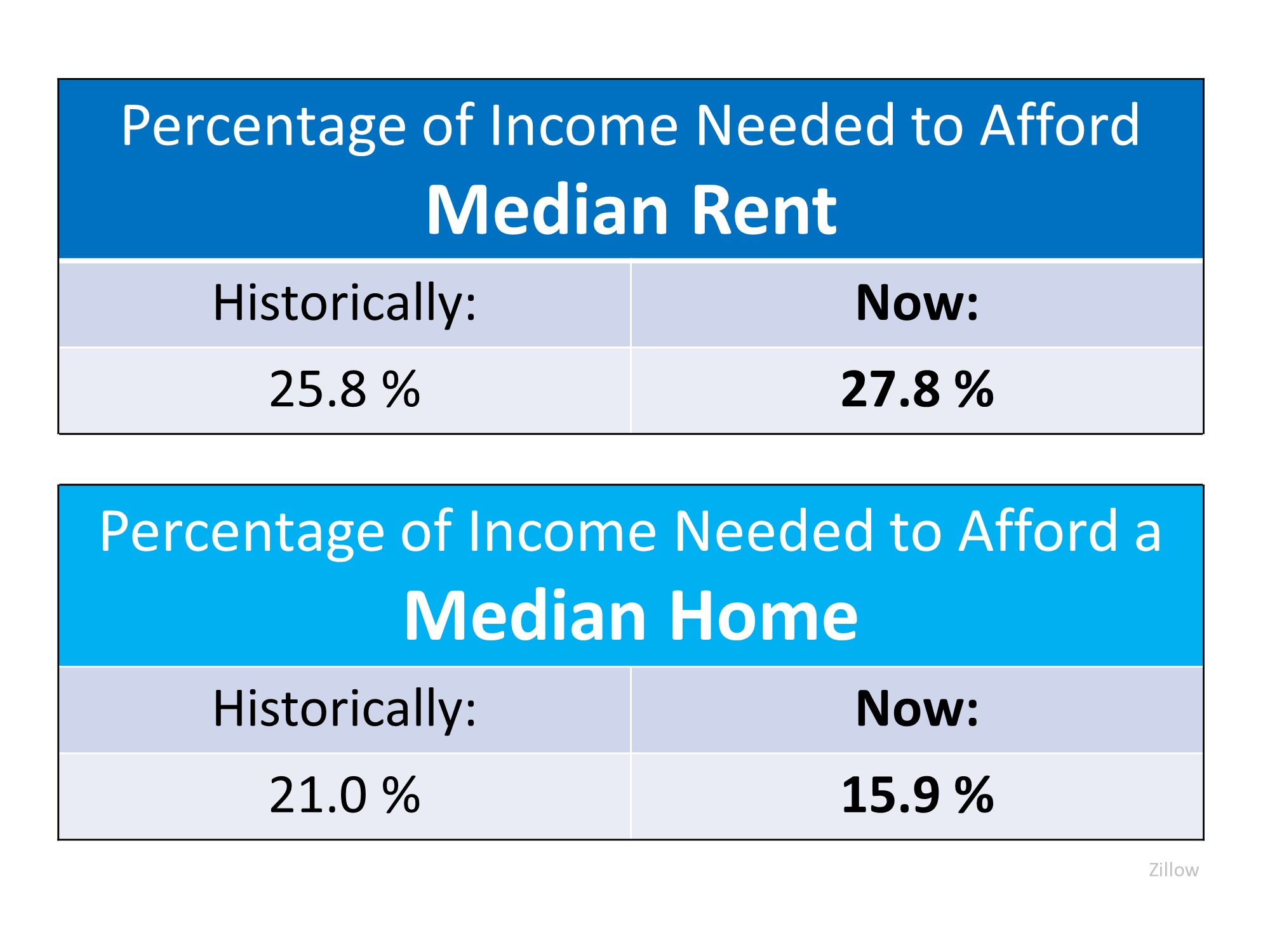

- Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it. Just take a look at the cost of renting vs. buying

Why 2019 Was a Great Year for Homeownership

Last year at this time, mortgage rates were 4.63% (substantially higher than they are today). If you’re one who waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates combined with increasing wages are making homes much more affordable than they were just one year ago, so it’s a great time to get more for your money and consider a new home.

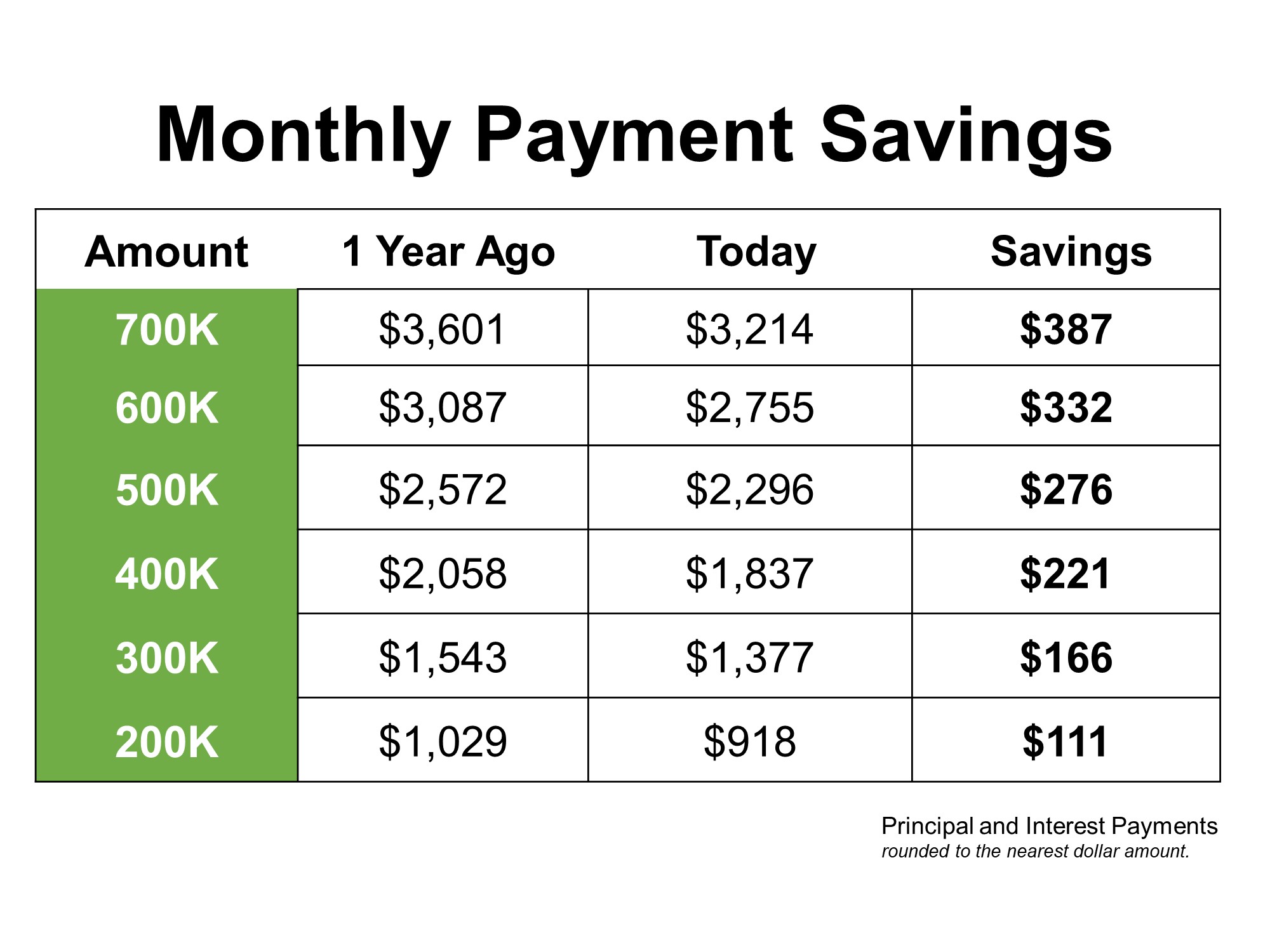

The chart below shows how much you would save based on today’s rates, compared to what you would have paid if you purchased a house exactly one year ago, depending on how much you finance.

Bottom Line

If you’ve been waiting since last year to make your move into homeownership, or to find a house that better meets your needs, today’s low mortgage rates may be just what you need to get the process going. Let’s get together to discuss how you can benefit from the current rates.

|

|

|

JERRY TORRES Sr. Mortgage Loan Originator | Vision One Mortgage, Inc “THE PERFORMANCE TEAM”

#TechieLoanOriginator | #JerryTorresPro |

![Buyers Are Looking For Your Home [INFOGRAPHIC] | Simplifying The Market](https://www.jerrytorres.pro/blog/wp-content/uploads/2019/11/20191129-MEM-ENG-scaled.jpg)